All Categories

Featured

Table of Contents

Keep in mind, nonetheless, that this does not state anything about changing for rising cost of living. On the plus side, also if you assume your alternative would certainly be to purchase the securities market for those 7 years, and that you would certainly obtain a 10 percent yearly return (which is far from specific, especially in the coming years), this $8208 a year would be greater than 4 percent of the resulting nominal supply worth.

Example of a single-premium deferred annuity (with a 25-year deferral), with four payment choices. The month-to-month payment below is highest possible for the "joint-life-only" alternative, at $1258 (164 percent greater than with the instant annuity).

The method you purchase the annuity will certainly establish the solution to that inquiry. If you buy an annuity with pre-tax bucks, your premium reduces your taxed revenue for that year. Nevertheless, ultimate repayments (regular monthly and/or round figure) are taxed as routine revenue in the year they're paid. The advantage below is that the annuity might let you postpone tax obligations past the internal revenue service payment limits on Individual retirement accounts and 401(k) strategies.

According to , acquiring an annuity inside a Roth strategy causes tax-free settlements. Buying an annuity with after-tax bucks beyond a Roth causes paying no tax on the section of each payment associated to the original premium(s), however the remaining part is taxed. If you're establishing an annuity that starts paying before you're 59 years old, you may have to pay 10 percent very early withdrawal charges to the internal revenue service.

How long does an Lifetime Income Annuities payout last?

The advisor's primary step was to develop a comprehensive financial plan for you, and after that discuss (a) just how the recommended annuity suits your total plan, (b) what options s/he considered, and (c) exactly how such options would certainly or would not have resulted in lower or higher payment for the expert, and (d) why the annuity is the exceptional choice for you. - Annuity interest rates

Certainly, an advisor might attempt pushing annuities also if they're not the ideal suitable for your situation and goals. The reason could be as benign as it is the only product they sell, so they fall prey to the proverbial, "If all you have in your tool kit is a hammer, pretty soon every little thing starts appearing like a nail." While the expert in this scenario may not be dishonest, it increases the threat that an annuity is an inadequate option for you.

How do I get started with an Tax-deferred Annuities?

Because annuities usually pay the representative selling them much greater payments than what s/he would certainly receive for investing your cash in shared funds - Annuity income, let alone the no compensations s/he 'd obtain if you spend in no-load common funds, there is a large incentive for agents to press annuities, and the more challenging the far better ()

A dishonest consultant suggests rolling that amount into brand-new "much better" funds that simply take place to bring a 4 percent sales tons. Consent to this, and the expert pockets $20,000 of your $500,000, and the funds aren't likely to carry out far better (unless you picked a lot more inadequately to start with). In the very same instance, the consultant could guide you to get a complex annuity with that $500,000, one that pays him or her an 8 percent payment.

The expert hasn't figured out just how annuity payments will be taxed. The expert hasn't disclosed his/her compensation and/or the costs you'll be billed and/or hasn't revealed you the impact of those on your eventual payments, and/or the compensation and/or fees are unacceptably high.

Your family members history and present health and wellness indicate a lower-than-average life span (Fixed indexed annuities). Current rates of interest, and thus forecasted settlements, are historically reduced. Even if an annuity is best for you, do your due persistance in comparing annuities offered by brokers vs. no-load ones sold by the issuing firm. The latter may require you to do even more of your own research, or make use of a fee-based monetary expert who might receive settlement for sending you to the annuity issuer, yet may not be paid a greater compensation than for other investment options.

Where can I buy affordable Lifetime Payout Annuities?

The stream of monthly settlements from Social Protection is similar to those of a deferred annuity. Given that annuities are voluntary, the people purchasing them normally self-select as having a longer-than-average life span.

Social Protection benefits are completely indexed to the CPI, while annuities either have no inflation security or at most supply an established percentage annual rise that might or may not make up for rising cost of living completely. This type of biker, just like anything else that enhances the insurance provider's risk, requires you to pay more for the annuity, or approve reduced settlements.

Variable Annuities

Please note: This short article is planned for informative objectives only, and need to not be taken into consideration monetary advice. You should consult a monetary specialist before making any major monetary choices. My profession has had many unforeseeable spins and turns. A MSc in theoretical physics, PhD in speculative high-energy physics, postdoc in particle detector R&D, research study placement in speculative cosmic-ray physics (including a pair of check outs to Antarctica), a short job at a little design solutions business sustaining NASA, followed by beginning my own small consulting method sustaining NASA tasks and programs.

Because annuities are meant for retired life, tax obligations and penalties may use. Principal Protection of Fixed Annuities.

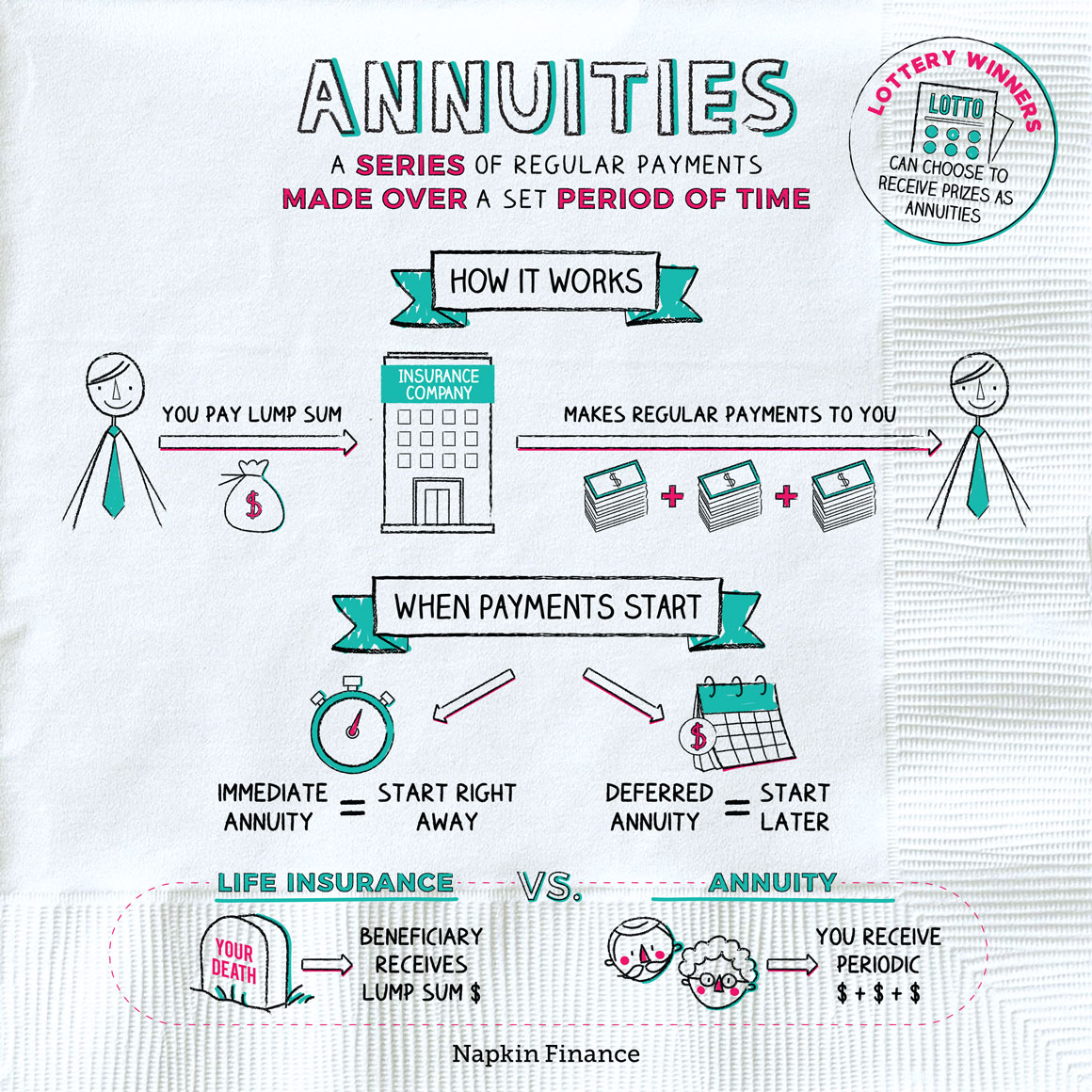

Immediate annuities. Deferred annuities: For those that want to grow their cash over time, but are eager to defer accessibility to the cash till retirement years.

How much does an Annuity Accumulation Phase pay annually?

Variable annuities: Gives higher capacity for growth by spending your cash in financial investment options you pick and the ability to rebalance your portfolio based upon your preferences and in a means that lines up with altering economic goals. With fixed annuities, the business invests the funds and provides a rate of interest to the client.

When a fatality insurance claim accompanies an annuity, it is essential to have a called recipient in the agreement. Different choices exist for annuity survivor benefit, depending on the agreement and insurance firm. Choosing a reimbursement or "period specific" alternative in your annuity offers a death advantage if you pass away early.

How long does an Fixed Indexed Annuities payout last?

Naming a recipient other than the estate can help this process go much more smoothly, and can help ensure that the proceeds go to whoever the individual wanted the cash to go to instead than going with probate. When existing, a death benefit is instantly included with your contract.

Table of Contents

Latest Posts

Decoding How Investment Plans Work Everything You Need to Know About Tax Benefits Of Fixed Vs Variable Annuities Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Different

Breaking Down What Is Variable Annuity Vs Fixed Annuity Everything You Need to Know About Immediate Fixed Annuity Vs Variable Annuity What Is Fixed Vs Variable Annuity Pros And Cons? Features of Varia

Decoding How Investment Plans Work Everything You Need to Know About Fixed Vs Variable Annuity Pros Cons Defining Fixed Income Annuity Vs Variable Annuity Pros and Cons of Various Financial Options Wh

More

Latest Posts